Search

Since the potential of selling goods and services to “bottom of the pyramid” consumers was identified by C.K. Prahalad and Stuart L. Hart nearly 20 years ago, base of pyramid marketing, sales and distribution have evolved with the help of technology.

TaroWorks clients like International Development Enterprises ([iDE] – a market-oriented development organization) and Sustainable Organic Integrated Livelihoods ([SOIL] – which provides affordable sanitation services) are using mobile app and cloud-based technology to implement as well as gauge the effectiveness of base of pyramid marketing and sales programs like product discounts, product giveaways and improving sales agent network performance.

A challenge of any base of pyramid marketing program is understanding the types of incentives that can motivate consumers at or below the poverty-line to purchase goods and services in emerging markets. Research on base of pyramid consumers in India indicates such customers are generally not “deal prone” – focusing more on company loyalty and aspirational product benefits – except in a few cases when very specific types of discounts are offered.

“Findings show two dominant patterns in deal proneness amongst the BoP consumer: First, a low level of deal proneness and second, a presence of deal specificity, when deal prone,” according to Shruti Gupta, professor of marketing at Penn State Abington. Gupta’s research indicates “… that three promotional offers are most well received by the BoP consumer – price discount (for example, 25% off), volume discount (A four pack for the price of three) and a product premium (get earrings with the purchase of … ).” (Download Findings: “An Exploratory Investigation of Deal Proneness at the Bottom of the Pyramid”)

Base of pyramid marketing and sales efforts include a range of methods used to drive home the value of goods and services to consumers in developing markets and remove financial or other obstacles to purchases by the poor. For a social enterprise, this could be offering a coupon or voucher that provides a product discount when the customer presents a card or a code at the point of purchase. It can also be providing sales training to field agents who deal with customers in the last mile and then tracking agent productivity.

What does it take to actually implement product discount voucher programs or to manage and monitor sales agent networks when operating in remote areas with little or no internet access or mobile data connectivity?

Here are three examples of how TaroWorks’ offline field service mobile app and companion Salesforce.com cloud CRM are being deployed to facilitate base of pyramid marketing and sales efforts.

iDE uses TaroWorks’ mobile offline field services app and Salesforce CRM to help manage its Cambodia WASH program, which works to match sales agents with individual latrine builders to market, sell and distribute latrines to base of pyramid consumers. (Read More)

Since 2009, iDE has helped sell more than 330,000 latrines reaching over 2 million people and generating an annual household benefit of around $83, according to Daniel Clark, an Information Systems Developer at iDE. Speaking during a recent TaroWorks webinar, Clark said the base of pyramid marketing efforts eventually reached a turning point. Since the program’s inception, iDE has seen latrine coverage across the provinces rise to around 70%.

“However, in spite of the overall efficacy of those sanitation marketing efforts, iDE recognized that market actors are not always necessarily incentivized to reach the poorest segments of the market,” Clark said.

In 2016, analysis was done on sales from 2011-2015 in the first iteration of iDE’s sanitation market. Additional research found that traditional financing mechanisms like microfinance loans generated modest demand while increasing program costs and complicating the sales process.

Clark said customers classified as poor were often unable or unwilling to pay full market price for a high-quality latrine. iDE tested targeted subsidies using TaroWorks and Salesforce to issue and track discount vouchers that when presented at the point of purchase, could reduce the cost of the latrine.

The Cambodian government’s national system for identifying those in poverty allowed the voucher test to track “deal proneness” against income level to gauge if incentives would encourage base of pyramid consumers to buy.

Existing workflows within Salesforce were used to record sales occurring during the voucher test with sales data collected through a modified TaroWorks data capture form. “This in turn created an order record in our system and allowed for easy follow up by our pilot program staff,” said Clark.

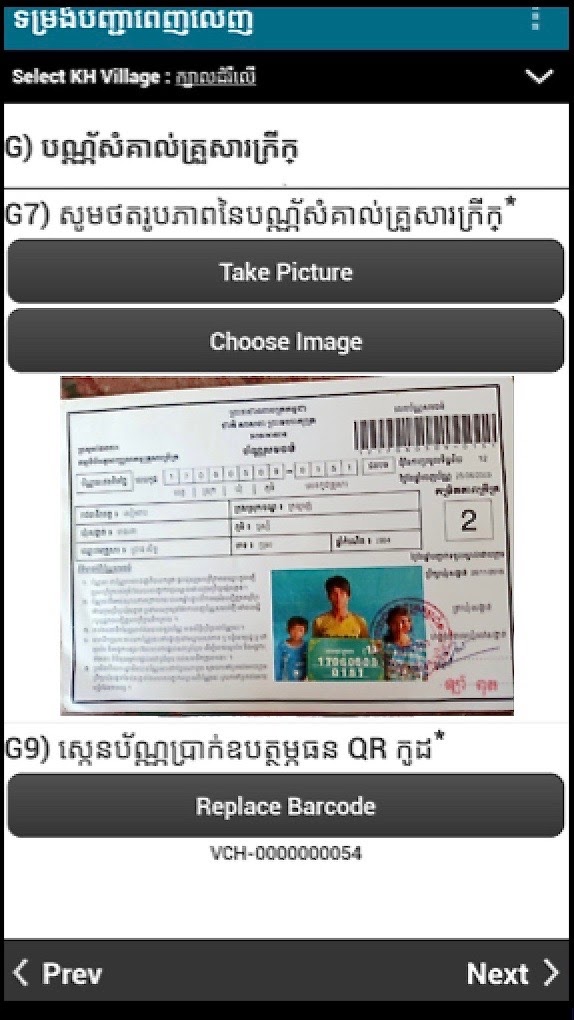

iDE integrated TaroWorks and Salesforce into the voucher system process to manage voucher creation and track voucher distribution from the program’s head office, to field managers, to sales agents, and over to customers qualified using Cambodia’s poverty ID system. This technology was also used to verify voucher authenticity, execute the purchase and deliver payment to latrine manufacturers.

iDE further digitized the voucher tracking process using TaroWorks’ built-in QR Code functionality, tracking transfers between users at each stage of its journey to the customer and preventing data entry error. Portable printers turned the digital vouchers into paper discount slips to be claimed and purchase receipts to be issued.

SOIL’s field agents first used pen and paper to log sales, toilet installations, weekly servicing and other business activities and then transcribed the information into spreadsheets. SOIL now uses TaroWorks’ offline mobile CRM capability instead to help manage operations including providing company payment collectors access to a customer’s payment history and to conduct market research surveys. Salesforce data visualization dashboards give SOIL’s managers powerful business insights into the most effective sales and marketing techniques.

These Salesforce reports and dashboards helped SOIL determine the most effective base of pyramid marketing and sales tactics. For example, SOIL conducted customer research on which offers drive the most toilet sales. In one experiment, SOIL customers in some areas preferred receiving bonuses for referring new customers — in toilet paper rather than cash.

SOIL used that insight to identify similar neighborhoods and now uses hygiene products as incentives in those areas. SOIL data analysts also discovered that their customers responded more to time-limited discounts, like special weekend sales offers, than monthly promotions. (Read More)

Scott Roy, Managing Director and Owner of Whitten & Roy Partnership – a sales consulting firm which helped iDE retool its emerging market sales operation for the Cambodia WASH program – identified five common base of pyramid sales mistakes: Recruiting the wrong people, not knowing how to sell behavior change products, insufficient sales team training and development, misallocating and mismanaging sales territory and (of particular interest to TaroWorks) poor data management. As I’ve written before:

“It’s not just how you collect sales and other field data that matters, said Roy, but what data you choose to collect and how you use that data to manage your sales efforts or make other business decisions. Sales data collected in the field can’t just focus on the manager’s data needs and sales goals (like number of units sold and how actual sales compare to sales goals).

Data must also shed light on how the seller is performing by tracking metrics like when the team member starts and ends their day, the number of sales calls made and the size of completed sales. Getting this type of data, which Roy calls ‘input numbers,’ can help diagnose seller weaknesses while allowing the sales manager to provide constructive suggestions for improvement.” (Read More)

Returning to iDE’s testing and mobile device management of voucher discounts to spur latrine sales, Information Systems Developer Daniel Clark concluded his TaroWorks webinar presentation with these observations:

“The study found uptake rates among the poor households that were offered subsidies increased substantially while at the same time demand has maintained among the unsubsidized households. Furthermore, we also found the increase in sales and subsequent economies of scales for our program resulted in the lower cost per latrine based on the effective targeting.”

Tracking voucher-supported sales using Salesforce reporting dashboards, iDE determined that while 20% of overall sales were made to consumers classified as poor by the Cambodian government in 2015 – before the voucher test began in 2018 – over 30% of all sales in 2019 were to poor customers. iDE has seen this percentage rise to over 50% so far in 2020.

The value of mobile and cloud-based technology in managing the voucher program also became clear to Clark:

“Finally as an interesting anecdotal takeaway we also discovered through the research that tracking vouchers with only a paper trail was not scalable so a digital solution was not only desired but required.”

Many TaroWorks customers previously used paper and spreadsheets to collect data, analyze metrics and run field operations. Let us show you how TaroWorks’ offline mobile field service app can help scale your business by digitizing sales and supply chain management, increasing agent network productivity and analyzing data in real-time for business insights.

POST TOPICS

Sign up to receive emails with TaroWorks news, industry trends and best practices.

TaroWorks, a Grameen Foundation company.

Site by V+V