Search

In advance of the ICTforAg conference in Washington, DC on June 23rd, we assembled a panel of experts to share their thoughts on the future of ICT4Ag, especially as it applies to mobile agriculture. Listen to their thoughts in this Webinar.

They bring a range of experience to the discussion including having consulted for private agribusinesses and built strategic alliances, collected millions of data points to increase farmer productivity and provided distribution channels for important agriculture information.

Our panelists include:

In the past few years, we’ve seen an exciting proliferation of tools and apps that cater to very different needs in the value chain for smallholder farmers. What’s next for ICT4Ag? Here’s what the panelists think.

Mobile Agriculture 2.0 is a result of lessons learned from ICT4Ag 1.0, which started at the same time as mPESA in 2007 in Kenya. A key lesson learned from the first wave of ICT4Ag, which is now driving this new era, is that it doesn’t matter how brilliant an app is designed but rather whether the farmer at the bottom of the pyramid will be able to see the value of the tool immediately – not at harvest months later. We need to move away from the notion that farmers are able to provide for the sustainability of the tool. We need to climb higher in the value chain in order to find players who have the financial capacity.

Another major theme of Mobile Agriculture 2.0 is the bundling of capabilities. In Mobile Agriculture 1.0, there were entrepreneurs all over the world designing applications that they thought would solve all the problems in agriculture. We’ve learned that we need to bundle these now because rarely does a solution only require one function. The two channels that encapsulate the different mAg needs are:

Organizations like Grameen Foundation are passionately committed to advancing the use of mobile technology in agriculture. Mercy Corps has an AgriFin Accelerate program. USAID/Vodafone Connected Farmer Alliance and USAID Mobile Money Accelerator Program have paved the way for Mobile Agriculture 2.0

Source: Grameen Foundation

When we bundle functionalities, we’re maximizing the value proposition for the farmer by directly connecting them to the supply chain. This at the same time maximizes the value proposition for the anchor agribusiness and the mobile money channel and anybody else who’s part of the strategic alliance.

Services like mPESA have hit critical mass. It’s grown from being used for simple use cases like sending money to family or paying utility bills, but now we’re starting to see that they’re available for much wider uses. Now that the functionality has been proven, we’re seeing more systems incorporating it into their solutions.

In terms of access to big data, increasing weather variability makes it as important as ever to get tailored information to smallholders to be addressed immediately. Big data is the confluence of being able to aggregate information about the soil, the weather and how to best gain access to the market so that the yield can be optimized in a very tailored manner. Optimizing the harvest with the smallholder is ultimately what will reap benefits through the rest of the value chain, so being able to use the data and using technology as a channel to share the information is critical right now.

Another reason for current timing that came up in the Q&A is that the increasing affordability of touch screens and smartphones is also providing information for more visual learners. This allows more a trusted information channel on tools with which farmers are increasingly getting comfortable. A study showed that with trusted channels, farmers are more likely to try something new. However, this does depend on comfort levels and also whether they value the information. We see farmers saving up money to use Facebook and WhatsApp because they see value in staying connected. Education and training is still very crucial to adoption.

Different programs like CGIAR’s Platform for Big Data in Ag and Gates Foundation’s focus on digital agriculture strategy have recently been created to think about the role of big data in agriculture.

The overall theme seems to be how do you package all of this research data in conjunction with technology solutions to help smallholders take action? How can we scale knowledge through “digital agronomy” and “digital extension” with the intent to arm the extension officers with far more information than they would normally deal with, but to also have the tools at hand to solve for very real-time issues?

Where big data comes into play is that it’s the way to scale science. If researchers develop a new variety and know how it reacts to specific conditions on the ground, there’s an opportunity to optimize plantings at the farm level.

The system modeling allows farmers to do things to improve quality, which leads to higher prices at market. The overall goal of big data is to connect science and the best thinking, and refine it so that the bit of information is provided to the farmer is precisely the information they need at just the right time so as to address the challenges they face on a day-to-day basis.

In addition to pushing this information out, it’s also useful to capture how that information was used by the farmer, and adjusting so that it’s most impactful and comprehensible.

The big goal is to have tailored content so that all strategic partners are able to use the results to inform decision making – whether it’s the farmer making decisions on their farm or the financial institutions making financial decisions.

Source: TaroWorks

We also need to acknowledge that a key shortfall for ICT4Ag implementation is the lack of awareness of the tools that are out there, by everyone from the farmer to the managers at the agribusiness. The development sector is learning lessons fast and we need to make sure that these shortfalls aren’t duplicated. The technology actually isn’t the limitation – in fact, it’s probably overextended in terms of how the farmer is able to use it. Educating potential users on what capabilities are out there is extremely difficult but is one of the most important challenges to overcome in order to move into Mobile Agriculture 2.0.

In any value chain you need to determine a good way of communicating best agricultural practices. Usually, it’s a very traditional approach since it’s so seasonal. What we need to embrace is that the technology tools and new channels must be part of this information mix.

A few lessons that apply to where Mobile Agriculture is heading. There’s a spectrum of extremes showing up:

The question is do you create niche solutions or go for a single system? There’s a “full stack” approach that combines different functions into one system. There are “vertically-integrated” solutions that are very deep into a specific process, like Esoko. There are also ad-hoc approaches that do a single function like mobile data collection, SMS data collection.

The challenge is how to get all of the data to work together. At TaroWorks, we believe that the single source of connections is the farmer’s identity. By tying it at that level, we’re essentially creating a farmer relationship management system. Whatever form the system takes, that core identity should be the farmer.

There are also knock-on effects of being farmer-centric. An extension of this identity focus is that when digitizing cash crop payment streams, you’re actually creating a form of financial identity for the first time. This empowers farmers to join the formal financial structure.

In general, these linkages are building overlaps across different industries. M-KOPA provides a useful example: The company started as a solar lantern company but added on payments. What they began to see is that with a basic identity information, a third-party came in the mix. A solar irrigation tool was able to use that information as well to increase the value.

PEG Ghana was another PAYG home solar provider. As farmers are paid for their crop via mobile wallets, they can use that income to make payments against the PEG system. Because of these mobile technologies, there are additional business distribution models (PAYG solar, M- Irrigation, etc.). These are cropping up like wild mushrooms after a rain.

Mobile Agriculture 2.0 now becomes designing business model innovations instead of the latest technology. We’re also starting to see the blending of different industries so agriculture and solar energy start to work in tandem.

Farmerlink Is a strategic alliance with aWhere information being distributed via SMS. TaroWorks is also a delivery channel for the Grameen Foundation which was the business model innovator that pulled together these partners including, buyers, financial institutions, and agriculture extension agency and additional messaging platforms (early warning system, engageSpark). Global agribusinesses are realizing that these cross-sector partnerships are necessary to solve the issues.

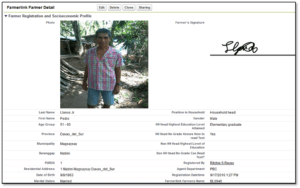

A farmer profile uploaded from a mobile device using Grameen Foundation’s FarmerLink app powered by TaroWorks and Salesforce.com

New technologies to address agricultural issues are still very exciting but in order to realize full value for the farmer and expand the value chain, there must be a shift to innovating on business models to start connecting multiple tools. With a system that is more encompassing, there will be more value for stakeholders and more financing can come from players that are higher in the value chain.

Much technology adoption relies on solving a problem. A small app could very well solve a problem but it’s very niche and problems are often all-encompassing. We need to acknowledge that we have an infrastructure all the way into the smallholder household. And importantly, these are self-financed phones – farmers might not have eaten for a few days to save up enough money to buy a phone. It’s now incumbent on the development world to work on these business model innovations focused on solving a problem so that farmers will benefit.

Also, because of digital innovations, farmers are finally able get their voices heard in aggregate so it’s on the development world to use this information to continually improve on how we work with the farmers.

POST TOPICS

Sign up to receive emails with TaroWorks news, industry trends and best practices.

TaroWorks, a Grameen Foundation company.

Site by V+V